A little more wealth creation in Atlantic Canada would be a good thing

A few weeks ago I posted a chart shown the spread in average household income in the ‘poorest’ Census Tract in the Moncton CMA to the ‘richest’ and compared that to other jurisdictions. A Census Tract is kind of similar to a neighbourhood - usually with 5,000 or so residents. That analysis showed there was a far lower gap between the richest and poorest neighbourhoods in Moncton compared to, say, Toronto.

My point was that IMO we should be building neighbourhoods specifically to encourage a diverse mix of residents because higher income cloistered neighbourhoods tend to have better schools, lower crime, etc. and can exacerbate inequality in a variety of ways. I realize this kind of thinking is hard with legacy neighbourhoods (i.e. Rosedale in Toronto) but with any new development municipalities can encourage a mix of housing and use other tools to ensure a diverse neighbourhoods.

A drive-by commentor lumped me in as just another socialist. They suggested I must not like rich people or something to that effect.

In fact, as someone who studies local economies in great detail, I think we need more rich people - particularly Atlantic Canada needs more rich people. Or, to be specific, people who create surplus wealth by innovating, developing new ideas and products or earning a wage premium because they are excellent at what they do (other ways of earning surplus income such as rent seeking, labour supply suppression, speculation, graft, etc. is not grouped in here).

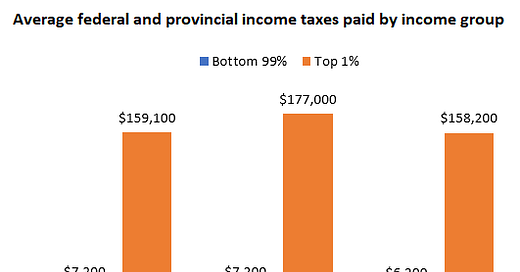

People who earn high incomes pay a lot more taxes. The chart below shows the average federal and provincial income taxes paid by the top 1% and everyone else (mostly like you and I). The top 1% of income earners in Nova Scotia paid an average of $177,000 in income taxes in 2020 - real taxes - not some theoretical tax bill. This compares to an average of $7,200 for everyone else - the bottom 99%. To put it another way, the richies pay 25 times as much in income taxes.

It doesn’t stop there, of course, because Canada has a consumption tax, property taxes and other taxes. The 1%ers in Nova Scotia likely pay conservatively in the range of $50,000 - $75,000 more every year in other kinds of taxes bringing the annual tax bill to closer to $250,000/year. And, yes, this would push their total tax rate above 50%.

The 1%ers contribute a lot to the total taxes raised in Atlantic Canada but if we had more of them (yeah, I know what a percentile is, I am talking in generalities here) or if they earned more income they would pay an even larger share of total taxes. Take Ontario, for example. The 1%ers pay more than a quarter of all income taxes in that province (26%) - a 2.8 times larger share than in New Brunswick.

A lot more rich folks paying these high taxes - let’s say getting up to the Ontario level - would do a lot to reduce the need for Equalization.

So, my point is simple. I don’t want less rich people in Atlantic Canada, I want more (based on my criteria above) but I still think we can design cities to try and limit cloistering rich folks away from the rest of us.

Scott Galloway, NYU professor and social media star, talked recently about what he called the ‘workhorses’ - these are folks in the US that earn between $150k and $1M and that have an effective tax rate of 45-50%. Unlike lower income earners, they face the highest marginal rates and benefit less from tax breaks and unlike high income earners they don’t have as much opportunity to defer taxes and take advantage of other tax advantages.

In Canada we have a similar situation although the $1M upper band is high - very high in the case of Atlantic Canada.

Quite frankly, we need these workhorses - who pay a lot more in taxes than they take out in public services. I was joking with my wife recently that since Trudeau took power my parents and my kids have seen substantial increases in federal income transfers. HST rebates, OAS top ups, carbon tax cheques - my parents had no idea why their income had swelled by thousands of dollars until we went through their bank statements. Meanwhile back at the ranch, Adriana and I are just paying more taxes (and happy to do it).

I may not be a workhorse in the 1% range but let’s say I am a work-donkey.

We want to ensure we have enough of these workhorses in our region to do the heavy lifting when it comes to the taxes we need top sustainably fund public services.